5 Ideas for Online Investing in Africa

It’s nice to have a little bit of money in savings. It’s even better when you can invest that money and watch it grow over time.

Given modern technology, investing is now easier than ever. Are you interested in online investing in Africa but don’t know where to start? Here’s a rundown of 5 ways you can invest your money and enjoy strong returns.

1. Stocks

Stocks are a traditional investment vehicle. When you buy stock, you’re buying a small portion of a large company, and your investment rises or falls based on the fortunes of that company. It’s often smart to invest in so-called “index funds,” which include many different stocks to minimize risk.

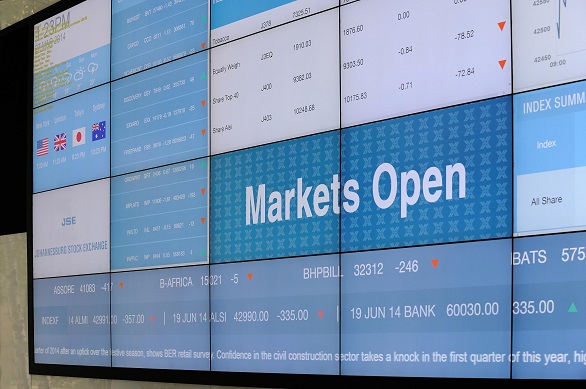

Finding an online platform for investing is a little bit trickier. You’ll need to find an online investment portal that services your specific country. For example, if you live in Kenya, you can buy and sell stock on the Nairobi Securities Exchange through firms like Apex Africa Capital. Here’s a look at the largest stock exchanges on the continent:

- Johannesburg Stock Exchange in South Africa (JSE)

- Nigerian Stock Exchange in Nigeria (NSE)

- Egyptian Stock Exchange in Egypt (EGX)

- Casablanca Stock Exchange in Morrocco (CSE)

- Namibian Stock Exchange in Namibia (NSX)

You just need to search for a firm that allows online trading for the stock market in your country.

2. Foreign Exchange

Trading foreign exchange (or “forex,” as it’s called) is simpler in some way than trading stocks and more complicated in other ways. It’s simpler in that there’s no regulated exchange, so you can trade forex from anywhere in the world using just your computer. But, forex is the most liquid market in the world with prices changing each minute, which makes it much more difficult for new investors.

Because there is no regulated exchange for forex, there are fewer limitations on finding a broker online. Just make sure you read reviews before choosing a trading platform.

3. Real Estate

You can invest in real estate without purchasing your own rental property. Services like Realty Africa take online investments from around the world and then use them to fund hotels, factories, eco-lodges and other real estate projects. As those projects turn a profit, you get a cut of the profit in proportion to your investment. If you do want to purchase your own rental property, there are plenty of sites and services that will deliver options for you to consider. Angola, Nigeria, Egypt, Mozambique, Kenya and South Africa are among the countries that offer the best real estate investment opportunities.

4. Cryptocurrency

Cryptocurrency is digital currency that is created and traded outside the purview of a central bank, as more traditional currency is created and traded. Popular types of cryptocurrency include Bitcoin and Ethereum, and they can be traded via web-based platforms like BitPesa in Kenya and Luno in South Africa. Cryptocurrency is relatively new, and the prices of various forms of cryptocurrency can be volatile. Be careful as you enter this type of investment, and be sure to do plenty of research first.

5. Micro Loans

If you want to invest your money and do something good at the same time, consider micro loans. Services like Zidisha connect investors to borrowers in developing countries who need relatively small amounts of money for key investments. Sometimes borrowers need inventory for their stores, and sometimes they need equipment to provide a service. Platforms like Oiko Credit allow you to make your money available to others while earning interest.

It’s harder to enjoy significant returns with micro loans, but there is something fulfilling about seeing your money go to work in a meaningful way.

Always Do Your Research

Before you invest, always do your research. There’s both risk and reward with investing. Your goal should be to minimize your risk while maximizing your reward through whatever legal means you can.

Responses